If plug-in cars become a reality, how will we pay for highways without a federal gas tax? —Steve Phelan

You’re right that relying on a federal gas tax to pay for highway upkeep is an unsustainable scenario, Steve, but you’re not exactly describing some distant carbon-free future. It ain’t working now, either.

Consider: The nation’s roadways are supported by a tax on gas that goes into the Highway Trust Fund, established in 1956 to help build the interstate system. This arrangement derives from the quaint notion that the feds should be responsible for a few basic infrastructure-related commitments—say, drivable roads. But that proposition’s been in question at least since 1993, which was the last time Congress could agree to raise the gas tax (currently 18.4 cents per gallon for regular, 24.4 cents for diesel). According to one estimate, adjusted for inflation the value of the tax fell 28 percent from 1997 to 2011.

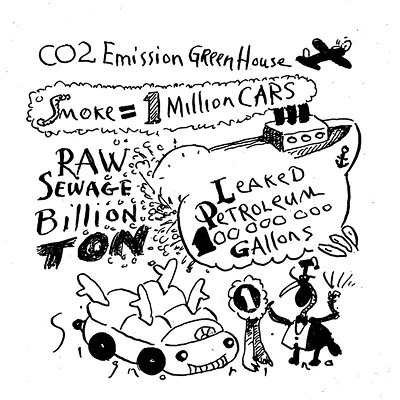

To put it mildly, we’re not keeping pace. A recent study by the American Society of Civil Engineers found that the U.S. will need to invest $2.7 trillion by 2020 to maintain roads, bridges, and transit systems. The federal levy (there are state and local taxes, too) currently pulls in about $30 billion a year, which, you’ll notice, isn’t quite going to make it. We can expect things to get worse. Not only has the tax not gone up; gas sales have been more or less stagnant since 2002. And the Department of Energy expects revenues to decline as much as 21 percent (from 2013 levels) by 2040.

Most of that has to do with stricter fuel-economy standards, and not a whole lot with any widespread adoption of electric cars. Indeed, in 2014 Americans bought a mere 123,000 new electric vehicles, out of a total of 16.5 million new vehicles sold nationwide. According to government projections, just 7 percent of the cars on the road in 2040 will be hybrid or electric-powered. So, to sum up:

1. Some means are needed for dramatically increasing the revenue going to U.S. roads, bridges, etc.

2. Electric vehicles, while depriving the trust fund of a little bit of cash, won’t make the situation appreciably worse than it already is.

Still, if we figure out a way to wean ourselves from the gas tax now, we’ll be better equipped for some eventual future that involves more widespread use of electric cars and other non-gas-burning vehicles. (High-speed long-distance rail? Hey, a guy can dream . . .) Ideas floated in this regard include a federal tax on the purchase of new vehicles, an annual tax on vehicle registrations, and a mileage-based tax.

Of these, the mileage-based user fee, or MBUF, seems to have the greatest traction. California is currently looking for 5,000 volunteer drivers for a pilot program to determine the feasibility of such a regime; Oregon has signed up more than 1,000 since last July. It makes sense on its face, but some logistical issues present themselves: How, for instance, to track the mileage? One way would be an annual odometer inspection, but doing away with the relatively painless per-gallon tax add-on and replacing it with a yearly lump sum is going to be a tough sell for consumers. What about a device in the car that records mileage continuously—say, via GPS? This raises obvious, and understandable, concerns about privacy; it’s not like the government doesn’t have access to enough of your personal data already. A study undertaken by the Colorado Department of Transportation investigating the idea of an MBUF system neatly encapsulates the challenges to its implementation: the authors concluded that Colorado would be best off as a “near follower,” rather than a “national leader,” in adopting MBUF. In other words, let somebody else figure out the details, and then we’ll think about it.

That’s at the state level, of course. Might such a system be adopted nationally, such as meets the funding needs of the country’s crumbling transportation infrastructure? Don’t be ridiculous. Meanwhile, this time last year President Obama had just floated a plan to bolster the transportation fund with a 14 percent repatriation tax on offshore cash held by U.S. corporations—a perfectly fine proposal, and one with zero chance of becoming reality in the current political climate.

It’s possible we’re not thinking nearly far enough outside the box here. A recent Wall Street Journal article suggested that, with the dual advent of self-driving cars and ride-sharing concepts such as Uber, individual vehicle ownership might swiftly be on its way out—and good riddance: the piece noted that in the U.S., the usage rate for cars is 5 percent, meaning that the other 95 percent of the time they just sit in the driveway. In the paradigm-shifting scenario envisioned, travelers wouldn’t own their driverless cars; they’d pay by the mile. This still doesn’t solve how to pay for roads, of course. Some things even Silicon Valley can’t fix.

Contact Cecil via straightdope.com

or write him c/o Chicago Reader, 350 N. Orleans, Chicago 60654.<ital>Send questions to Cecil via straightdope.com or write him c/o Chicago Reader, 350 N. Orleans, Chicago 60654.<>