FALL IS in the air and Savannah is buzzing with back to school excitement. But here’s a question for every college student before you set your schedule this semester:

Are you getting ripped off?

I place a very high value on education and I have immeasurable respect for teachers. As an adjunct professor, I came to understand the difficulty, and occasional heartache, of guiding young people toward a career. When searching for that first job, many skills and talents are difficult to demonstrate on a resume or without a proven work history.

By no fault of the faculty, the current system of higher education has evolved to a point where most young people are not being served. Over the past 10 years, I’ve watched many of my friends and former students fall into debilitating debt, which has affected their lifestyle and mental health.

In the 1950’s, college education held an intrinsic value that was priceless. My grandfather told me, “you go to college to learn how to read a book.”

What he meant, by extension, is that college would teach me to see books and the world with a critical eye. It was an invaluable skill that prepared students for success in any arena.

In the 1980’s, greedy institutions and lenders saw how higher education was under-priced and so they sought to wring more profit from a system that historically benefited the customer, as well as society at large.

When real estate values became tied to the local high school’s college placement rates, everyone in town had an incentive to collude. Guidance counselors pushed the plan with an Oprah-like cadence, “EVERY. BODY. GOES. TO. COLLEGE!”

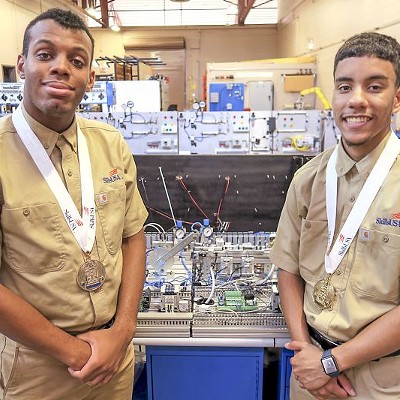

Shop classes were cancelled. Vocational apprenticeship programs died off for lack of interest.

Two generations of young people were told by their parents and teachers that mental labor is far more valuable than manual labor. The only way to achieve financial freedom, we were told, was to first get that degree — no matter the cost.

Demand for 4-year degrees went up, and the price steadily surged. But as students took on larger loans, the market value of each degree actually went down.

We saw grade inflation and an explosion of “Easy A” classes (History of the Beatles was popular at my undergrad). Requirements for the humanities and foreign languages were reduced or dropped completely.

Online classes, while offering remote access to some, removed personal interactions between students and teachers. More classes were taught be Teaching Assistants, and tenured professors were gradually replaced with adjunct professors to avoid offering benefits and pensions.

Employers started to see that job applicants were gaining credentials more often based on their ability to pay, and decreasingly because of any particular merit or unique achievement.

As a result, recent graduates weren’t offered the high-paying jobs they needed to pay off their debt.

The pursuit of knowledge should be motivated by curiosity. But when that pursuit is driven only by financial survival, the entire experience is tainted.

Classes are chosen either for convenience or quick return on investment. Exploration and experimentation are lost, and the chance of finding a new serendipitous path in life is greatly diminished. Education becomes a cold, joyless utilitarian chore.

My father often joked that he could have bought me a McDonald’s franchise for the price of my degree. (Why get an education? I could have been a manager right out of the gate!)

It wasn’t always this bad in America. The increase in tuition prices over the last 20 years has so drastically surpassed meager gains in wages that paying off student debt and the accruing interest is a mathematical impossibility for many.

Even for graduates who find a steady job and a fulfilling career, the rest of that comfortable white-collar life they were promised is a long way off. Many aren’t able to take vacations, buy a house or save for retirement until they’re 50 years old.

The ability to raise children is delayed, sometimes indefinitely. Living a more prosperous life than one’s parents, that once quintessential measure of the American Dream, has been made unachievable with student debt.

We live in a free country, yet 44 million Americans have signed on to a life of indentured servitude, chipping away at $1.5 trillion collectively.

Imagine spending 30% of your after-tax income on a single bill. You must live with roommates. Unexpected auto repairs get delayed. You can’t save enough to move to a bigger city for more opportunity.

You lose touch with friends who can afford more expensive leisure activities. Even owning a pet becomes a burden. Much like that financially tainted education experience, your every minor decision is made in service to that monthly bill.

In an unfair system where most people take years or decades to catch up, there is no shame in quitting while you’re ahead. If you’re able to see your situation clearly and cut your losses, that makes you a WINNER!

Will your school set you up with an interview for a good job? Or will you be starting your own business as a freelancer?

How much will your new job pay?

How much will your loans be every month? $500? $1,000? For the next 20 years?

Where do you really want to devote your time in this one life?

People change their minds, and that’s okay. Perhaps that thing you were passionate about is better suited (and even more fulfilling) as a hobby instead of a career.

Maybe your training is already finished and you don’t need more classes. Maybe all you need is a couple months to fix your website, proofread your resume, and start applying for jobs.

There are thousands of Ivy League classes available for free online. There’s a do-it-yourself YouTube channel for everything. The public library is wide open.

If you really want to learn from an expert in-person, there are affordable continuing education classes that you can audit for half the price.

So, this semester, before you sink another $10,000 in debt, consider that you could be saving that money to invest in a house one year earlier, or buy a dependable car, or finish your independent film, or do a hundred other things that will put you on a track to financial and mental independence.

A degree is just a piece of paper, and your education doesn’t end when you leave the classroom.