NOBODY likes to pay taxes. The only consolation we may have is that everyone has to do it, and we’re hopefully all paying our fair share.

The anger is created when cracks appear in this system.

We have seen incompetence on the side of taxing authorities, favoritism for acquaintances, and good old-fashioned corruption. Sometimes it’s hard to pinpoint the reason for a lack of uniformity, but we inherently know it just isn’t right.

A document from the Faith, Justice and Truth Project was published on June 11, 2019, entitled:

“Georgia Sales Tax Erosion: Big Retailers Are Not Paying Their Fair Share.”

Consider this: The report looked at Chatham County’s five Walmart stores and took information from Chatham County’s Comprehensive Annual Finance Report (CAFR).

In the period from 2008-2017, Walmart’s composite assessed value only increased by 11%. Oddly, other commercial composite values in Chatham County increased by 49%.

If Walmart had increased in value by 49%, then that would have translated into $23 million more in assessed value.

It begs the question, why is there such a disparity?

More curious are the cases of Gwinnett County and Cherokee County. In Gwinnett, the ten stores studied had a composite decline in value of 42%, but other commercial properties declined by 5%.

What is there about Walmart properties that make them lose value so quickly in comparison to other businesses? If Walmart had only a 5% loss in valuation, it would have brought $80 million more in valuation into the county coffers.

In Cherokee County the contrast is even more eye opening. The Comprehensive Annual Finance Report showed the composite of four stores declining in value by 17%, but the commercial sector in the county grew by 21%.

Again, even the most ardent Walmart supporter would have to wonder what was happening here. The net result in lost taxation for Cherokee County would be $20 million more in valuation.

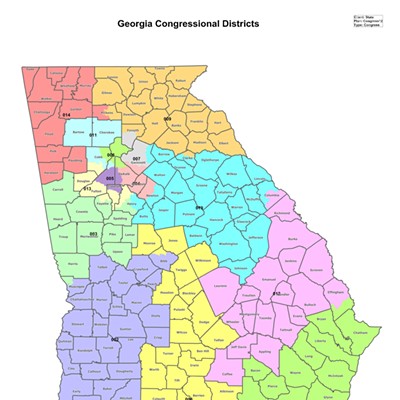

All 159 counties across the state of Georgia are in desperate needs of funds to repair and upgrade infrastructure, provide affordable housing and recover from two major hurricanes that went through the area.

If they had access to this kind of reserve funding, it would have helped immensely.

It would also relieve the governments of over-taxing residential properties as a means of balancing their fragile budgets.

This is only one part of the “Walmart Conundrum.” In Part 2 of this inquiry, the report will claim that Walmart has not collected sales tax properly under the Internet Sales Tax Law that went into effect in 2018.

As a result, a third-party provider can sell on Walmart.com and there is no way for the person buying to pay a sales tax using the website. That means losses of sales tax in Georgia close to $82 million or more.

While the report only looked at Walmart and Etsy, one has to wonder what is happening over at Amazon.

Uniform taxation is the law of the land in Georgia, and under the Taxpayer Bill of Rights, we have a duty to ask our representatives to look into this situation and correct it.

It is a prime example (no pun intended) of how state and local officials can work together on a revenue plan that levels the playing field on the commercial sector.

For mom and pop operations that run their own e-commerce sites, it takes away the unfair advantage some third-party stores had hiding under the Walmart umbrella. Everybody would collect sales tax and pay their fair share.

Big-box stores and corporations have happy faces, but behind them are lawyers who are not afraid to come down hard on any opposition from governments to their current tax payment strategies.

It will be a very public and very vicious battle. If the big-box stores lose, their prices might not be falling so much, but it is possible your tax bill will fall.

In that case, be sure to tell Walmart to have a nice day. They’ll need a reason to smile.